Developers

Fuel your next project with fast, flexible finance – built by property experts, backed by trusted capital, and tailored for developers who deliver.

What makes CrowdProperty different?

CrowdProperty was built by property experts – people who understand the pace, risks and pressures developers face. We move fast, communicate clearly, and tailor funding that works in practice – not just on paper.

We look beyond the numbers – assessing the team, vision and viability of each project. With competitive rates, flexible terms and expert support throughout, we help you focus on what you do best – delivering quality developments.

CrowdProperty

Loan Calculator

I want to borrow: £5,000,000

| Loan Duration | Interest | Total |

|---|---|---|

| 6 Month Loan | £274,750 | £5,274,750 |

| 12 Month Loan | £549,500 | £5,549,500 |

| 18 Month Loan | £824,250 | £5,824,250 |

Happy with your results? Click below to begin the process.

Total repayments are for illustrative purposes only, calculated on an 11% interest rate. These figures should not be considered as financial advice or a guarantee of terms. Actual loan terms will vary based on individual circumstances.

What we fund

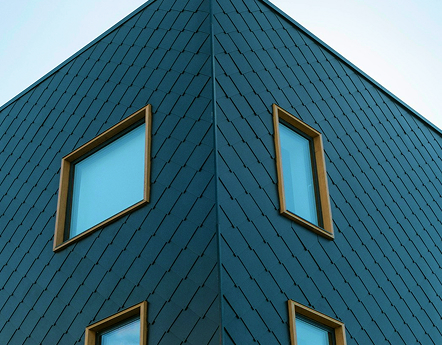

Development finance

For new builds or major projects, with tailored drawdown and raise. Up to 70% LTGDV and 100% development costs.

Heavy refurbishment

Funding for major refurbishments, with tailored drawdown and raise. Up to 70% LTGDV and 100% refurbishment costs.

Light refurbishment

Finance for minor refurbishments costing 15%-50% of market value. Up to 70% LTGDV and 100% refurbishment costs.

HMO & Co-Living

6-18-month funding, covering purchase and works for HMO conversions. Supports refinancing onto long-term mortgages.

Bridging

Fast, flexible finance for purchases, project stages, or unlocking capital. Up to 75% LTV, secured by First Charge.

Auctions

Quick-turnaround finance to meet tight auction deadlines for development or refurb projects. Up to 75% LTV.

Finish & exit

Bridging finance to ease loan commitments and achieve successful sale or refinance exit. Up to 75% LTV.

Airspace development

Funding for creative airspace projects, typically including modular builds and innovative housing solutions.

Modern Methods of Construction

Finance for cutting-edge construction, including modular, SIPP, and ICF, with unique cashflows and complex processes.

Development joint venture

Funding for developer-asset owner partnerships, to unlock unique opportunities and ease cashflow demands.

Special situations

Expert review and customised funding for unique or complex projects that don’t fit other product categories.

Our products

REAL

RESI

REFI

How we work

We simplify the funding journey – combining expert support, fast decision-making and clear communication from the start. You’ll be backed by a dedicated lending manager who understands the detail and pace of development.

From first enquiry to final drawdown, we’re with you every step – cutting delays, removing friction, and keeping your project firmly on track. It’s finance designed to move as fast as your ambition – without the usual roadblocks.

Developer Guide

Download our Developer Guide, for tips on choosing the right project, building the best team, and maximising your returns.

Hinton Saint George

CrowdProperty funded the development of 10 new build properties, of which three will be set aside for Affordable Housing, comprising of high-quality, traditional houses built using local “Ham” stone. The development team has undertaken over 20 co-living accommodation conversions, with this project being a natural progression of their property experience, moving into new build development.

Apply for funding

Getting started is simple. Apply in minutes to access property development finance or join our platform as an investor.